Data interpretation of the drone market, self-timer drones suddenly emerged?

As 2016 is about to pass, the performance of the domestic drone market in this year can be described as “mixed warâ€: the traditional Dajiang Dajiang launched the Phantom 4, Mavic Pro, Phantom 4 Pro, and Inspire 2 models. Technically, it still keeps pressing against other manufacturers, but the manufacturers represented by Zero Degree and HoverCamera are not sitting still. Several small drone products have been introduced by the concept of "self-timer drone". For a time, the entire drone market showed a hundred schools of contention. In the face of the emergence of many competitors, has the pattern of the drone market in 2016 changed?

Coincidentally

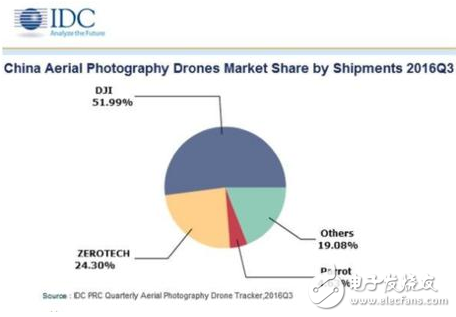

Recently, market research company IDC pointed out in the "China Aviation Drone Market Quarterly Tracking Report (Q3 2016)" that the number of shipments of drones in Dajiang in the third quarter of 2016 dropped to 52%. This is the first time that Dajiang’s market share has declined for four consecutive quarters. At the same time, zero-threshold shipments have risen to 24%.

What's more interesting is that the product that makes the zero-degree intellectual control share rise is just a self-timer drone called "Dobby", which uses Qualcomm's flight platform: Snapdragon 801 processor + 13 megapixel IMX214 camera. Life is below 10 minutes. However, the price of this drone has reached 2,599 yuan, which is 100 more expensive than the millet drone.

Dobby is able to stand out among the many drones and get such a large shipment in the third quarter, a large part of the reason comes from the industry's hot speculation about the concept of "self-timer drone", and the driving force behind this is the mobile phone. Chip giant - Qualcomm.

The Snapdragon flight platform launched by Qualcomm last year integrated many key modules of the drone, greatly reducing the difficulty of developing the drone. However, due to performance limitations, it can only be used on drones with small wheelbase, and there are many defects in camera, battery life, heat dissipation and stability. The price/performance ratio is not comparable to that of millet drones.

In order to plant the UAV market earlier, Qualcomm has launched several self-timer drones in conjunction with Zero Degree, HoverCamera, Spiral Intelligence, and Gabe Intelligent. Although the quality of the camera is lacking, the function is homogenized, and the price is too high, thanks to the media rendering and the spread of the product line, the shipment of “self-timer drones†has exploded in the third quarter. .

This is also why, in the "shipment" data counted in the IDC report, the "self-timer drone" headed by zero has such a large increase.

However, we should note here that in the calculation of market share, the use of "shipping volume" is not very strict. In the drone industry, the major shipments of major manufacturers are handed over to the agents. Even the millet drones that started from the network sales have the situation that the agents get the goods in advance. Not to mention the well-known manufacturers such as Dajiang and Zero.

An agent of Zero Degree in Beijing once said that for the popular product DOBBY, the sales condition given by Zero is that the single purchase quantity should not be less than 200 units. Therefore, "shipment volume" does not equal "sales volume". Due to the presence of inventory, the number of drones actually sold to end users is much smaller than that of shipments.

At the same time that the "self-timer drones" got together to launch a large number of distribution goods, the new products launched by Dajiang in the third quarter only had Mavic Pro with a price of up to 6499. This model is still in a predetermined state, and it is distributed from a large area. Nowhere in sight. In the third quarter, DJI can calculate the shipments. I am afraid that only the Phantom 4 or even the earlier Phantom 3 series will be launched in March this year.

In the third quarter, the concept of "self-timer drone" was booming. It was just the time when the old models in Dajiang were too old and the new products were not in the green. The statistics on "shipping volume" during this period were obviously inadequate.

So, what is the real situation of the drone market in the third quarter?

Leopard in the tube

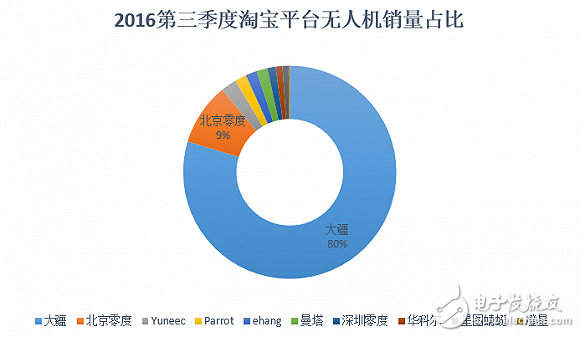

Let's take a look at the data of Taobao, the most representative online sales platform in China. Although it can't represent the real situation of the whole market, it can be seen as China's largest e-commerce platform.

It can be seen that in the third quarter of 2016, Dajiang still occupied an 80% share of the drone sales on the Taobao platform. The shares of all manufacturers except Dajiang are single digits, and the second-ranked Beijing zero is 9%, while the remaining total sales of all drone companies is only about 10%.

Such data is only Taobao, although it can not be said that Dajiang still occupies the vast majority of the drone market, but it can be seen that in the short-term, Taobao and other online channels of drone sales, the overlord of Dajiang The status has not been affected much.

The irony is that although the "self-timer drone" has risen on the Internet, the title of the text is not "moving the circle of friends", but it has not achieved better sales on the network channel. Under such circumstances, where can the offline sales be good?

Drinking thirst

Undoubtedly, with Qualcomm's launch of the Snapdragon UAV chip, drones are becoming more and more like the mobile phone industry: the barrier to entry is greatly reduced. As a result, a large number of miniaturized drones have appeared in the drone market. They are based on flight platforms provided by Qualcomm and others, and are called self-timer drones/mini drones/pocket drones.

Among them, the zero-degree DOBBY was released in early July. As the first self-timer drone that successfully shipped Lily and Zano, DOBBY has received a lot of attention from the media and consumers just after its release. As the only model currently sold at zero, Zero-Intelligence has done its best for DOBBY in the market. A large number of media have been invited to report and evaluate DOBBY, and the popularity is not high.

However, after a lot of attention, due to functional defects, Dobby could not keep the media and consumers concerned for a long time in shooting and playing. In the official forum of DOBBY, the content posts in each of the 7 days were less than 20, which was quite deserted.

The DOBBY, which enjoys the best of time, has not succeeded in hitting the traditional aerial drone market, nor has it succeeded in cultivating the habit of consumers using "unmanned self-timer". The reason for this is hard to say that it has nothing to do with the shortcomings of the "self-timer drone" itself, such as the endurance and image quality. After all, the publicity is cool, and ultimately, if you want to sell more products, you still have to look at the product experience.

The hard injury of the product itself makes the users in the wait-and-see "drawing the grass". The concept of the mini drone is no better, and the lack of good products can not maintain the heat.

Sleeping lion

In the past two years, the drone market, although seemingly blue ocean, has long been a red sea. According to statistics, there are currently only 400 Chinese drone companies. These hundreds of drone companies, with a lot of money and background, after a few years of competition, the status quo is still a big one in Xinjiang.

This is not a competition that is not intense enough. It is precisely because of fierce competition that it has fulfilled the status of Dajiang. Looking at GoPro, it is not difficult to find out. Its drone product, Karma, was hailed by the media after the press conference. It was called "Daijiang Killer" by many media, but only one week after the release of Karma, Dajiang Mavic Pro was born, Karma was almost forgotten in the blink of an eye, even if Mavic Pro is not shipped, but the craze has not yet disappeared.

At the present stage, the emergence of "self-timer drones" shows that the drone manufacturers made changes in order to avoid Dajiang. Although the products are still lacking, it is certainly zero and other manufacturers have won a glimmer of hope.

Product positioning differentiation is a good thing, but it is not a perfect solution. The author is most worried that if these "self-timer drones" products can not be iterated as soon as possible, perfect function, once Dajiang is involved in the "self-timer drone" field, I am afraid It’s a sorrowful sorrow.

Do not believe? Look at Karma, which is smashed by Mavic Pro, which is the best example.

Linear Actuators,Column Lift Linear Actuator,Motorized Linear Actuator,High Speed Linear Actuator

Kunshan Zeitech Mechanical & Electrical Technology Co., Ltd , https://www.zheteswitches.com