KPMG's 2016 Q2 Venture Report Report: AI Receives Gold

For global entrepreneurs and venture capital institutions, the impact of the cold winter of capital that lasts for more than six months seems to continue.

Recently, KPMG and CB Insights, one of the “big four†in the top accounting firms, jointly released the second quarter of 2016 global VC risk investment report. Data show that after two consecutive quarters of decline, VC venture capital transactions rose slightly from the first quarter, but the number of transactions fell four consecutive quarters.

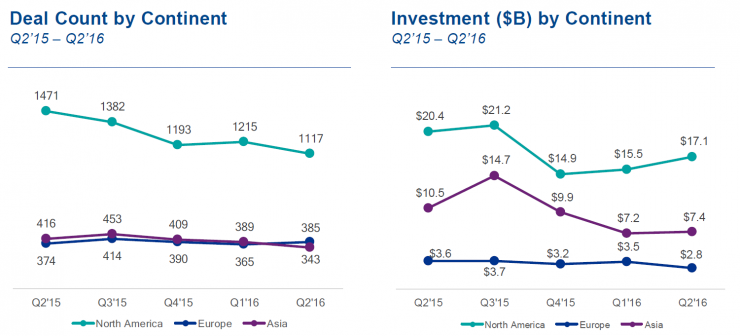

Overall, in the second quarter of the past, global venture capital has completed a total of 1,886 transactions with a total capital of US$27.4 billion. Among them, the number of North American transactions reached 1,117, and the funds were 17.1 billion U.S. dollars; Europe completed 385 transactions, reaching 2.8 billion U.S. dollars; and Asia completed 343 transactions, with total funds reaching 7.4 billion U.S. dollars.

The reasons for the increase in the total transaction amount and the decrease in the number of transactions are mainly due to the fact that some industry giants, such as photo sharing application Snapchat, Didi Chuxing and Uber, have huge financing scales and account for a large proportion of the total amount of venture capital investment in the second quarter. In fact, in North America, Uber and Snapchat alone raised more than $4.5 billion in investment, and North America's global total raised only $17.1 billion.

However, in the current quarter, especially by the British referendum on the Brexit, many investors stopped a large amount of investment; and the upcoming US presidential election also led to the implicit growth of US interest rates; at the same time, the stagnation of China’s economy also increased investment. The concerns of these people have adversely affected the current situation of global venture capital.

Let's take a look at the main contents of the next report jointly published by KPMG International and CB Insights.

Overall situation of the global zoningGlobal trading activities slowed markedly and North American transaction volume decreased significantly

In 2015, the number and amount of venture capital transactions were at their peak, compared with 2016, which was calm. Although there has been a slight increase in the transaction amount, the number of transactions and the degree of activity have declined for the fourth consecutive quarter .

In fact, in the fourth quarter of 2015 and the first quarter of 2016, global investment trading activities have been significantly reduced. However, in the second quarter of 2016, this figure has continued to fall below 1886, a year-on-year drop of 6%. Especially in North America, the performance is even more pronounced. After a slight increase in the number of North American transactions in the first quarter of 2016, there was another sign of decline in the second quarter. The number of transactions was only 1117, which was the lowest since the second quarter of 2011, but the transaction amount rose to 17.1 billion US dollars, which is due to the huge amount of financing of some large companies.

The Brexit's influence on Europe is yet to be considered

In 2015, European venture capital financing and trading activities had seen their heyday, totaling 1,600 transactions and a total price of US$14 billion. As of now, Europe has raised 6.3 billion U.S. dollars in 750 transactions this year.

The transaction amount in the second quarter dropped by 40% from the previous quarter, but the volume of transactions slowed. Judging from the current operating rate, ranking among the trading activities and investments in 2014 and 2015, it seems that the overall impact of Brexit on European venture capital has yet to be considered. It is still too early to draw conclusions.

However, most investors admit that they subconsciously believe that Britain's Brexit is not a correct choice. Some investors take a wait-and-see attitude toward Brexit, and hope to consider trading or investing for some time. After all, Britain has too much uncertainty after leaving the European Union; some people say that this may also bring some new opportunities. Based on the consideration of the priority of interest, the transaction will continue as usual.

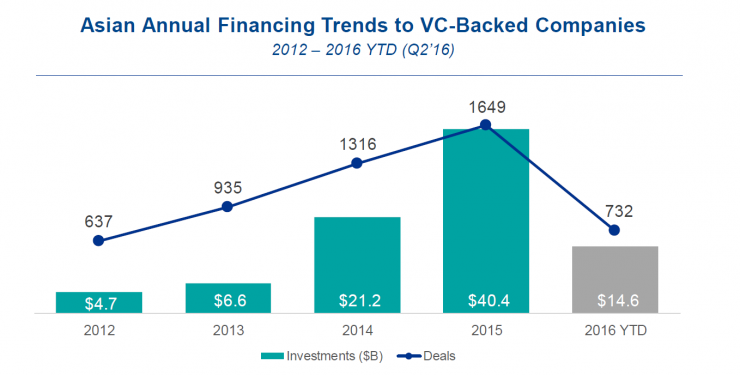

Asia's trading volume decreased by 12%, and the share of seed transactions rose slightly

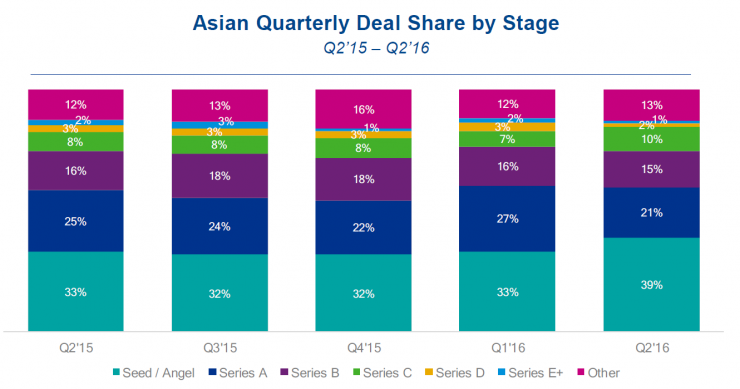

In recent years, the number and amount of transactions in Asia have maintained a steady increase. However, in 2016, there has been a downward trend. Up to now, in 2016, a total of US$14.6 billion was raised for 732 transactions. The number of transactions in the second quarter of this year also fell by 12% from the previous quarter. Since the first quarter of 2016, although the data of most platforms have been declining, the seed transaction in Asia has been relatively stable. Compared with 33% in the previous quarter, the share of Asian seed transactions in the second quarter of 2016 increased slightly to 39%.

Slowing transactions, the future is not optimisticTechnology companies account for the highest proportion, followed by medical care

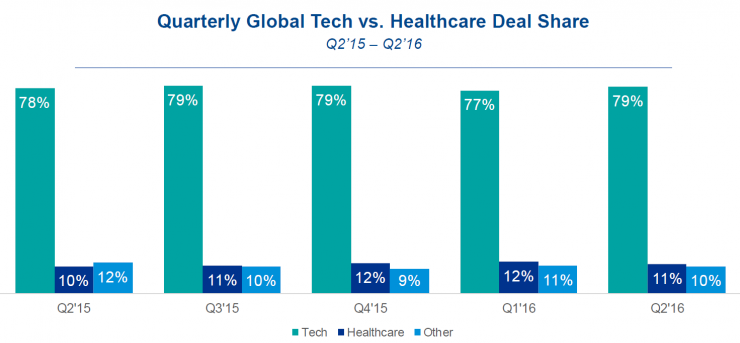

The report shows that among the global venture capital trading companies, technology companies account for the largest proportion. From the second quarter of 2015 to the second quarter of 2016, the ratio has remained at 70% or more; followed by medical companies, it has floated between 9% and 12%. In the field of science and technology, Internet and electronic communications companies account for the largest proportion, more than half of the transaction types. Â

Unicorn business status is not optimistic

According to quarterly data released jointly by KPMG International and CB Insights, in the past four months, seven unicorn enterprises (startup companies with a valuation of more than US$1 billion and one year of establishment) have been created globally, but there are also 17 companies. Less than market expectations, it encountered a "down event", which means that the company is financing or acquired at a lower valuation. This figure has been much better than the previous quarter, but it is not as exaggerated as last year's double-digit growth. The number of births of unicorns reached a high point in the third quarter of last year, when a total of 25 were born.

Brian Hughes, head of KPMG, said that due to the very slow development of global venture capital trading activities, replacing investors is particularly cautious. Many of the high-profile technology companies that conducted initial public offerings (IPOs) in 2015 are still trading below their issue prices, which puts pressure on the valuation of unlisted companies. Coupled with the market's concerns about the economic problems in China and Europe, these unfavorable factors will continue to put pressure on venture capital institutions, which will hinder global investment activities.

Global Investment Trends in Technology Fields"Artificial Intelligence, Virtual Reality" is attracting attention

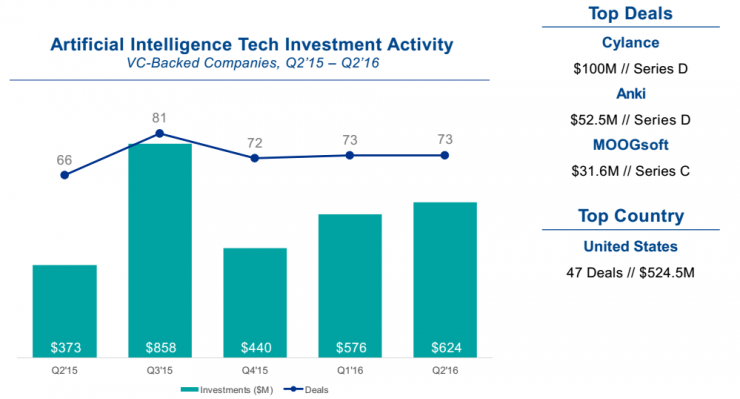

In the past five years, artificial intelligence venture capital has experienced rapid growth, from 282 million US dollars in 2011 to 2.4 billion U.S. dollars in 2015, including Google, GE (GE), Intel, and Samsung. Global risk investors are very active in this area and are expected to continue to maintain further growth next year. At a time when the global venture capital market is sluggish, artificial intelligence still maintains a relatively strong capacity. This can be attributed to the fact that AI technology supports the development of numerous innovative industries, from driverless cars to robot consultations. Platform, AI technology contributed to the promotion of global innovation.

Similarly, venture capital in the virtual reality field has also been significantly improved in Q2 2016. Global venture investors and virtual reality technology companies have announced a special fund worth US$10 billion to invest in related innovation projects. This fund also provides reference for follow-up global venture capital investors in this field. It is expected that the VR sector will achieve an exponential rise in the near future.

Digital Medical, Security Defense Development Slow

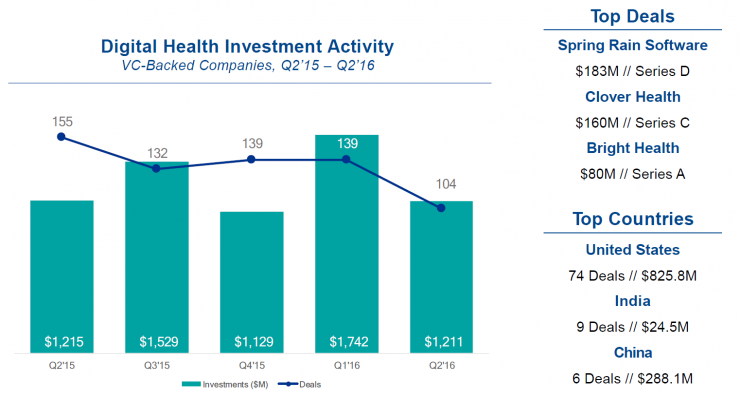

Compared with the previous quarter, the number of digital medical transactions and the amount of transactions have shown signs of decline, of which the number of transactions dropped to 104, a decrease of 24%, the total transaction volume fell by 3%. The security defense has seen a slight rebound. It is tempting to note that the standard compared to this year was 2015, when the data set a number of records, so it is not surprising that there has been some contraction.

Anand Sanwal, co-founder and CEO of CB Insights, said that it is difficult to increase trading activity in the next few quarters, but some transactions can maintain a higher level of total investment. To a large extent, these big deals can mask the weak state of the market and make it look healthier. "Although the total transaction amount looks bad, especially compared to the third quarter of 2015, but from a longer period of time, the number of transactions and the total amount of money are still very healthy. In other words, there is no When it falls down, the future is full of possibilities."