The three-legged balance of the battery industry has been broken, and the square battery has become a big show.

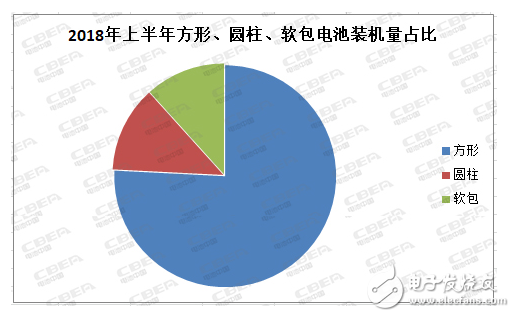

In the power battery market, square, cylindrical, and soft packs, as the power battery "three swordsmen", have been in a tripartite state for some time. Among them, the market share of square batteries is ahead of soft packs and cylinders, but the overall balance is relatively balanced. But now this situation has quietly changed, and the three-legged balance has been broken! Judging from the installed capacity in the first half of 2018, prismatic batteries have formed an absolute crush on cylindrical and soft-pack batteries, and the total amount far exceeds the sum of cylindrical and soft-pack batteries, and continues to maintain the status of the most mainstream type of power battery.

Square batteries increasingly show "ruler temperament"Data show that in the first half of 2018, the installed capacity of power batteries in the domestic electric vehicle market was 15.52GWh. Among them, prismatic batteries ranked first with 11.75GWh accounting for 75.77%; soft-pack batteries with 1.95GWh accounting for 12.53%, ranking second; cylindrical batteries with 1.82GWh accounting for 11.70 %, ranked third. Square batteries have increasingly shown the temperament of a ruler in the power battery market.

According to the solution, the current prismatic battery materials are mainly concentrated in lithium iron phosphate and ternary, while the types of prismatic battery supply vehicles are involved in the fields of new energy buses, passenger cars and special vehicles. In the first half of 2018, the 11.81GWh installed capacity of prismatic batteries was mainly supplied to new energy passenger cars and buses, of which passenger cars accounted for 46.23%, passenger cars accounted for 41.30%, and the two totaled 87.53%. The increase in sales of new energy passenger cars and buses has driven the installed capacity of prismatic batteries to rise sharply.

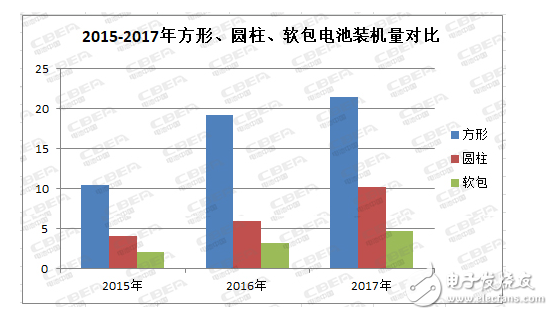

Judging from the development of the power battery market in recent years, the proportion of prismatic batteries and cylindrical and soft-pack batteries has been changing. Although prismatic batteries have also experienced a decline in market share, since 2015, prismatic batteries have The number one position in the power battery market has never changed, and the total amount is far ahead.

According to statistics from the Research Department of the Power Battery Application Branch, the total installed capacity of domestic power batteries in 2015 was 16.49GWh, of which the installed capacity of square, cylindrical, and soft-pack batteries were 10.42GWh, 4.01GWh, and 2.06GWh, respectively. 63.19%, 24.32%, 12.49%; the total installed capacity of domestic power batteries in 2016 was 28.28GWh, of which the installed capacity of square, cylindrical, and soft-pack batteries were 19.13GWh, 5.99GWh, and 3.16GWh, respectively , Accounting for 67.65%, 21.18%, 11.17%, respectively; the total installed capacity of power batteries in China in 2017 was 36.44GWh, of which the installed capacity of square, cylindrical, and soft-pack batteries were 21.47GWh and 10.7%, respectively. 24GWh and 4.73GWh accounted for 58.92%, 28.10% and 12.98% respectively.

Why is the prismatic battery market so strong? This is inseparable from its special performance. As one of the "Three Musketeers" of power batteries, prismatic batteries have the advantages of low internal resistance, long cycle life, high packaging reliability, good endurance, relatively simple grouping, and high system energy efficiency. They were once considered to be the most suitable for new energy sources. The battery design for automotive applications has been favored by battery and vehicle companies for many years.

Compared with cylindrical batteries, prismatic batteries are more plastic, and can be customized according to the specific needs of the products on board; soft-pack batteries have unbroken technical bottlenecks, so in terms of all factors, soft-pack batteries At present, the overall market competitiveness is not as good as that of prismatic batteries. Samsung SDI is a major foreign manufacturer of prismatic batteries. Wei Wei, vice president of Samsung SDI China, said that prismatic batteries have advantages for fast charging, mainly because the internal resistance of prismatic batteries is relatively small, so the temperature rise is easier to control. . At the same time, prismatic batteries can meet the needs of large-capacity single batteries, and the design requirements for BMS and PACK are relatively low. At present, many models use square batteries, such as BMW's i-series models, Roewe ERX5, Weilai's ES8 and so on.

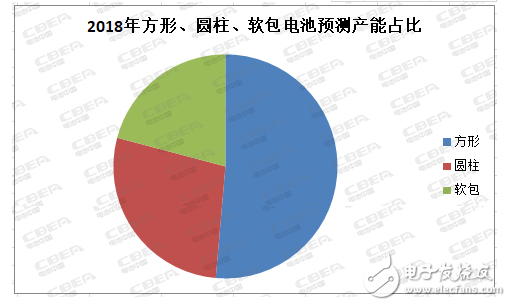

The prismatic battery market concentration is going to extremesSince 2018, power battery companies have increased their layout of prismatic batteries. Companies that mainly produce cylindrical power batteries are also vigorously deploying prismatic batteries, while prismatic battery companies are also adjusting product sizes and developing large-capacity batteries. As national policies and markets put forward higher requirements for power battery energy density and lightweight performance, the production capacity of prismatic batteries continues to rise. According to industry forecasts, the total power battery production capacity will reach 250GWh in 2018, of which the square battery production capacity will account for more than 50%.

At present, the production capacity of prismatic batteries is mainly concentrated in Ningde Times, BYD, Guoxuan High-tech, Lishen Battery and other companies. In 2018, the total production capacity of only these four prismatic batteries is expected to reach 71.5GWh, accounting for the proportion of total domestic prismatic battery capacity. As high as 85.6%. According to statistics from the Research Department of the Power Battery Application Branch, the total installed capacity of prismatic batteries in China from January to June 2018 was 11.75GWh, of which the installed capacity of prismatic batteries in the Ningde era was 6.49GWh, accounting for 55.23%; BYD’s prismatic battery installed capacity was 3.33GWh, accounting for 28.34%; Guoxuan High-tech’s prismatic battery installed capacity was 0.70GWh, accounting for 5.96%. The top three together accounted for 89.53%, and the market concentration of prismatic batteries has become an extreme trend.

There are still variables in the future power battery market patternAlthough the prismatic battery is currently the most mainstream choice of battery companies, its own performance shortcomings are also obvious. Because square batteries can be customized according to the size of the product, there are thousands of models on the market, and because there are too many models, it is difficult to unify the process. The prismatic battery can be used in ordinary electronic products without any problems, but it is used for large power batteries that require multiple series and parallel. Compared with the cylindrical lithium battery produced by the standardized production line, the production automation level of the prismatic battery is not high, and the monomer is different. In large-scale applications, its system life is much lower than the monomer life. At the same time, due to the difference of the square battery cells, it is not conducive to recycling and reuse.

The editor believes that due to the difference in specific packaging materials and structures, square, cylindrical, and soft pack batteries have their own advantages and disadvantages. Moreover, the power battery industry is currently undergoing a period of major changes, and various technological innovations are emerging one after another. It is not yet known which technological route will stand out in the future. At present, the production capacity of prismatic batteries is too concentrated. Once the market changes in the future, battery companies will face great risks. From the perspective of industry development, battery companies should focus more on technological innovation and long-term future, rather than short-term market share.

Laser radar contains LSPD safety laser scanner and LS laser radar. LSPD safety laser scanner is type 3 with CE certificate. It can be used for agv safety and industrial area protection. LS laser radar is for agv guide. Many famous agv manufacturers has installed LS laser radar to guide their agvs. Our cooperating brand contains Quicktron, Mushiny, Aresbots, etc. Feedback from customers are quite posotive.

Laser Radar,Auto Guided Vehicle Guide Radar,Sick Laser Radar,Safety Scanner,Safety Laser Scanner,Ls Series Laser Radar

Jining KeLi Photoelectronic Industrial Co.,Ltd , https://www.sdkelien.com